4 Time-Tested Steps to Build Generational Wealth

We have to understand that true wealth is not just about having money but about creating a sustainable financial ecosystem that can support our families for generations. We’ll uncover the secrets of how the wealthy build and maintain their fortunes.

BUY. BORROW. INSURE. TRANSFER

When it comes to building generational wealth, most people know the mainstream idea of working hard, saving as much as possible and then buy assets to leave something behind for our next generation, but a select group of people will follow a set of tried-and-true strategies that go beyond mere accumulation of assets.

We have to understand that true wealth is not just about having money but about creating a sustainable financial ecosystem that can support our families for generations.

From strategic investments to fostering financial literacy among their heirs, we’ll explore the practical steps that can help you emulate their success. Whether you’re looking to start your wealth-building journey or enhance your current strategies, these insights will provide you with a roadmap to creating a lasting legacy.

In order to create a sustainable financial ecosystem that can support our families for generations, there are actually only 4 main steps that have withstood the test of time:

STEP 1. BUY ASSETS

I have debated countless times with peers and pundits on what constitutes an asset in our current modern times with the prevalence of get-rich-quick schemes, meme stocks, the AI narrative, Bitcoin and the FOMO mindset. By definition, an asset is a resource with economic value that an individual, company, or country owns or controls with the expectation that it will provide future benefits.

An asset should have an underlying characteristic of being able to generate cash flows. An asset could also be a valuable commodity that the world actually needs like Gold or Crude Oil. A business with a balance sheet that can generate future cash flows can actually help us determine its intrinsic value and allow us to gauge whether the asset is currently undervalued or overvalued.

The first step of building generational wealth is the most important one because it sets the tone for the rest of your journey. Being deliberate in how we proceed with calculated risks and how cash flows are allocated will determine how we perceive the wealth that we want to create in the future.

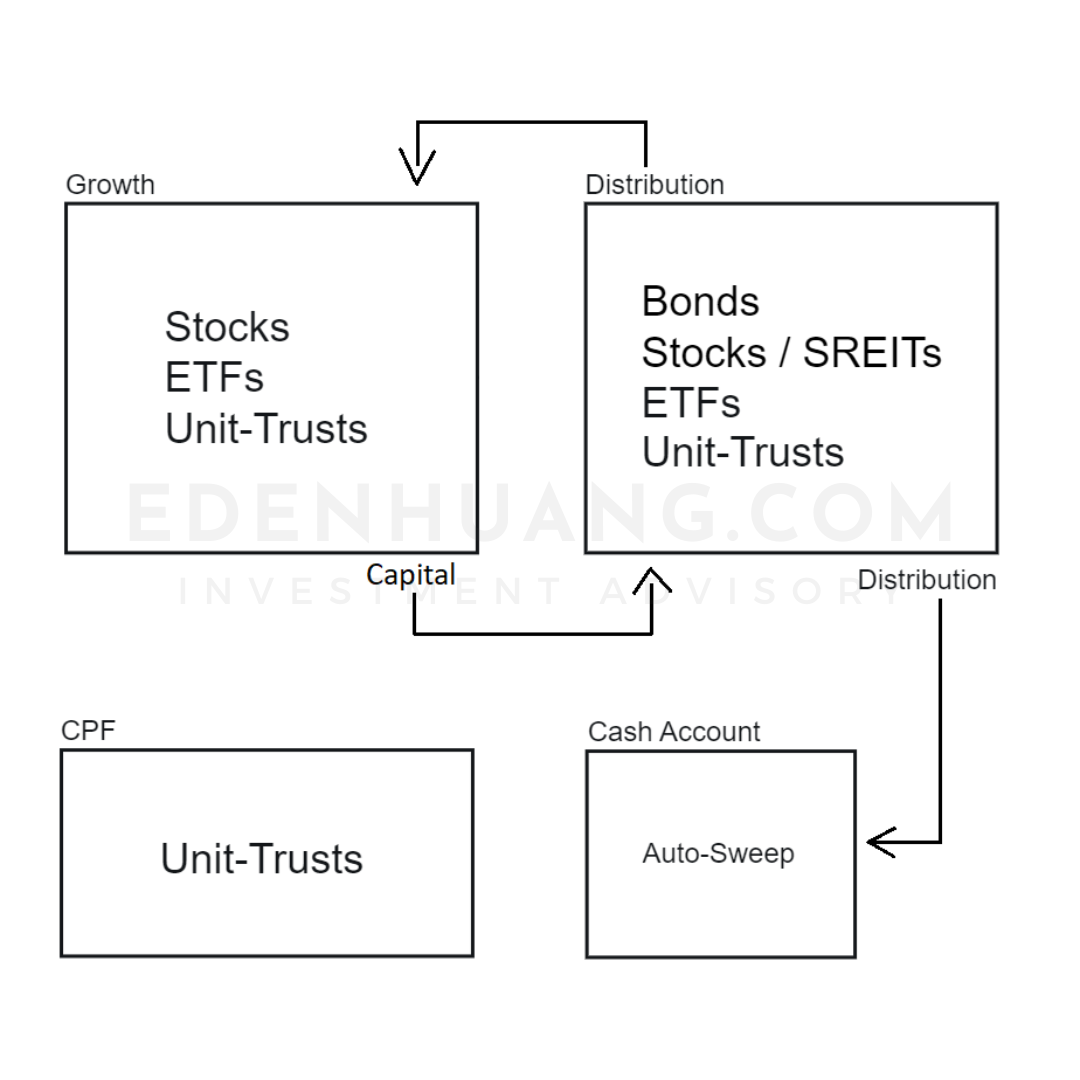

Instead of acquiring random assets here and there or over-diversifying, making our portfolios overwhelmingly complicated and unmanageable, we should focus on 2 main portfolio setups, a growth and a distribution portfolio as seen in the follow diagram:

The concept is to preserve and reinvest gains from the growth portfolio or other free cash flows back into the distribution portfolio by any means possible. Only taking on higher calculated risks with the distributions from the distribution portfolio or other free cash flows. Utilizing the growth portfolio to build up the distribution portfolio and in turn utilizing the regular distributions from the distribution portfolio to take calculated risks. This creates a perpetual loop that consistently building up the distribution portfolio.

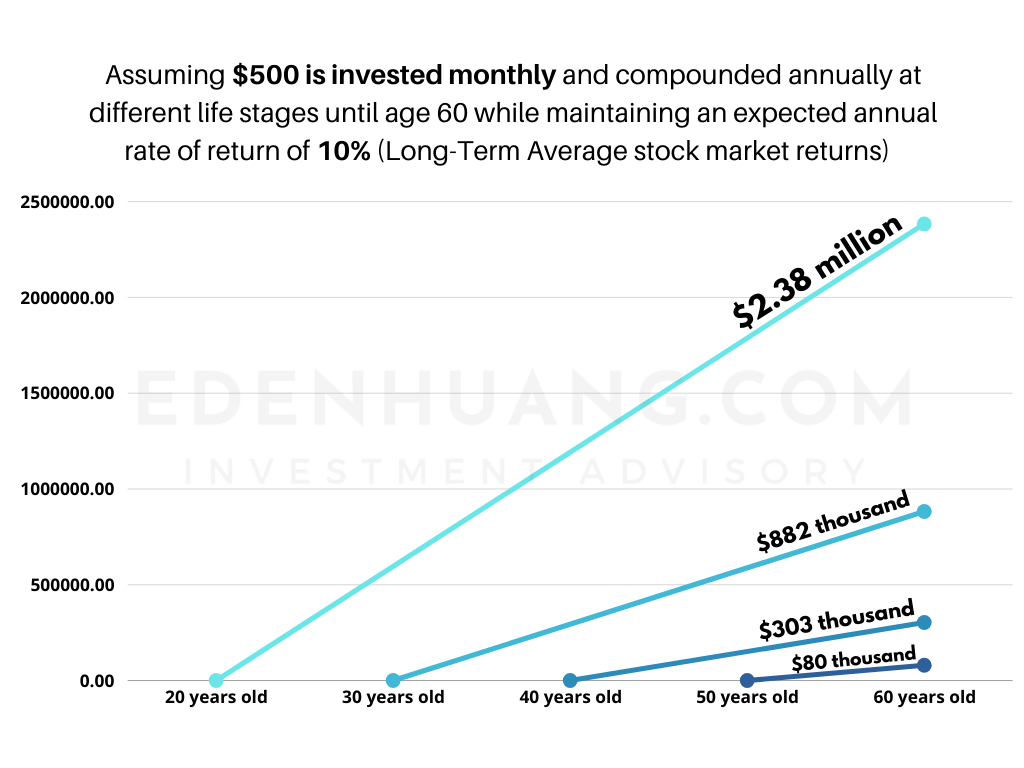

To illustrate how powerful this consistent strategy can become, I have re-created the conditions for compound interests in the following chart:

In summary the KEY Principles to this consistent strategy:

Start building an investment portfolio as early as possible.

Take only calculated risks.

Keep our Growth Portfolio entry prices low.

Keep our Distribution Portfolio yields sustainably high.

Monitor, Benchmark and Maintain our expected rate of return.

Adapt and adjust to economic shifts.

This consistent strategy has profound outcomes that most investors overlook in the short-term but reap compounding benefits in the medium to long-term. I have seen SO MANY cases from more than 10 years of my investment advisory career where people take unnecessary and uncalculated risks, aka the FOMO mindset, and lose a big chunk of their capital and assume THAT is the nature of investing and building wealth.

By maintaining this consistent strategy, which can be applied anywhere in the world, there could also be upside surprises along the way because we are laser focus on keeping our Growth Portfolio entry prices low.

The first step to Building Generational Wealth can be arduous and confusing with the current technological age of unrestrained information, but if there is a time-tested strategy that can keep us anchored and compound our wealth consistently instead of taking unnecessary and uncalculated risks speculating and "hoping" to beat the market, we might stand a better chance of reaching our wealth goals.

STEP 2. BORROW AGAINST OUR ASSETS

The second step is heavily being utilized by only a select group of people that understands the financial system and are determined to exploit it thoroughly. Financial institution that has amassed a huge amount of capital from revenues and profits will decide to lend out the capital to consumers and earn interests, converting the cash on their balance sheet to financial assets that generates cash flows.

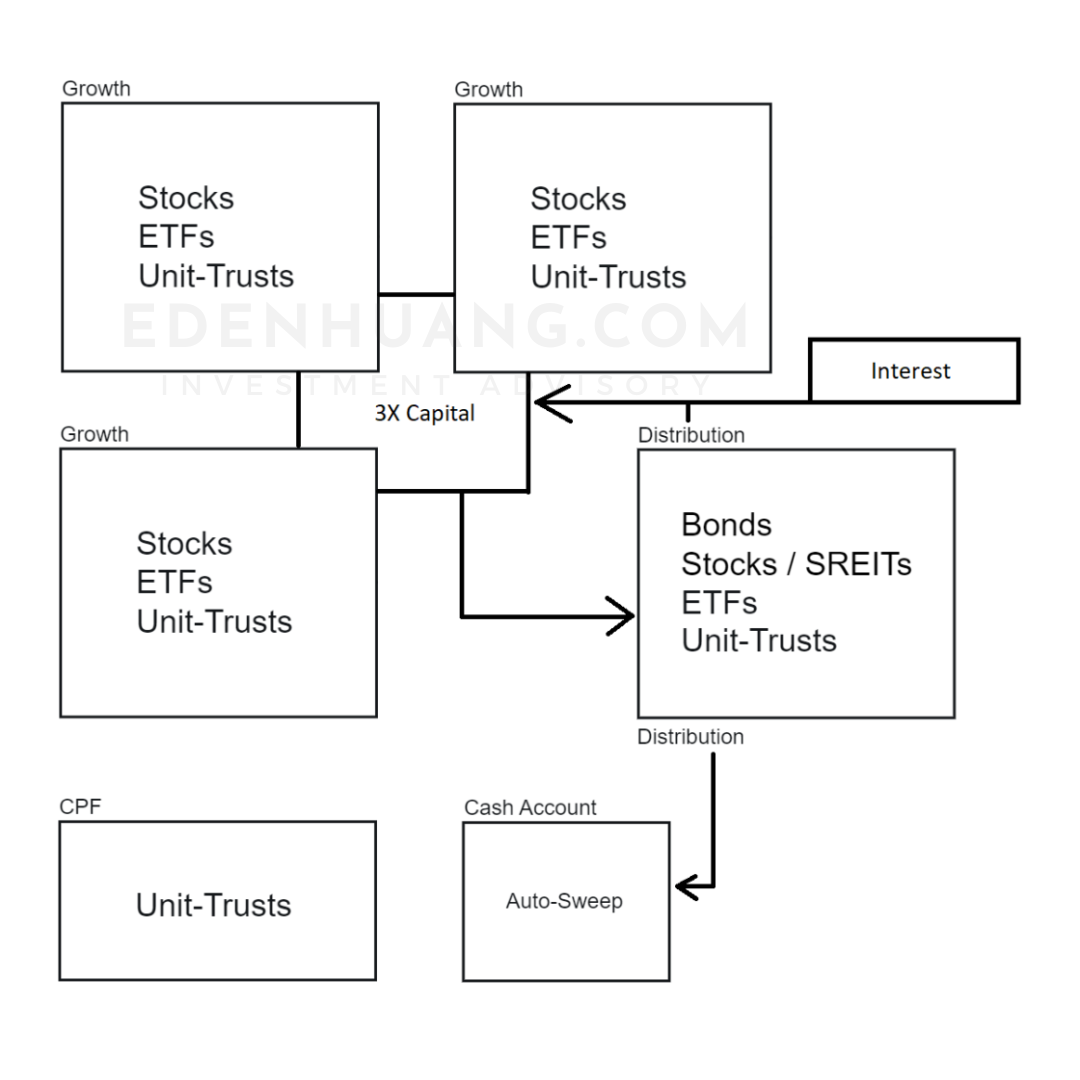

As savvy investors, we should be able to perceive the benefits of raising capital against our cash flow producing assets. It gives us the ability to multiply our buying power in the capital markets. This significantly amplifies the returns from investment if the risks and cash flows are managed strategically as seen in the following diagram:

The same consistent strategy of creating a perpetual loop that consistently build up our distribution portfolio applies here, but this time, by borrowing against our distribution portfolio that we have built as collateral, we were able to raise 3x the capital and strategically allocate the capital into 3 Growth Portfolios instead of just 1 previously. Managing our cash flows while accounting for the interest expense provides an unparalleled buying power in the capital markets that can help us capitalize on growth or magnify the distributions from our existing cash flow producing assets.

In summary the KEY Principles to Borrowing Against our Assets:

Build up a robust distribution portfolio to borrow against.

Become Laser focused on covering the interest with distributions.

Taking on only calculated risks and only acquire assets.

Keep our Growth Portfolio entry prices low.

Keep our Distribution Portfolio yields sustainably high.

Monitor, Benchmark and Maintain our expected rate of return.

Adapt and adjust to economic shifts.

⚠️ The cardinal mistake for this step is to spend the borrowed capital and not covering the interest with distributions.

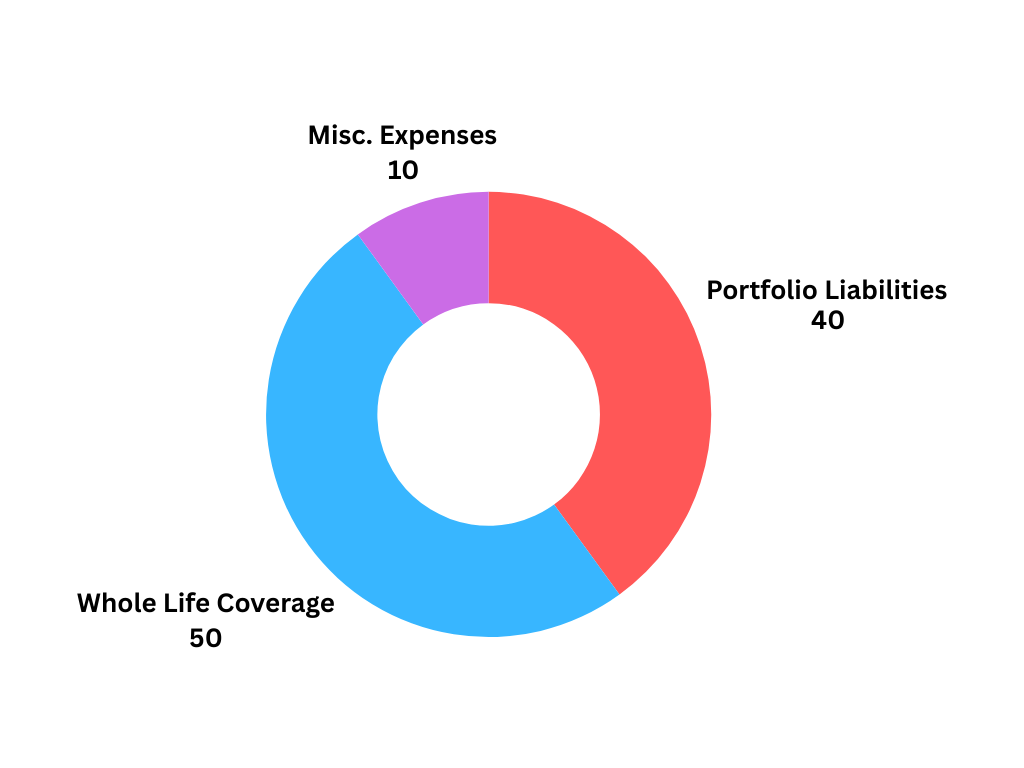

STEP 3. INSURE TO COVER PORTFOLIO LIABILITIES

Once we have the previous Step 1 and Step 2 in place and functionally cash flow positive, we can begin to divert some of the cash flows to purchase term insurance or whole life insurance to fully cover the portfolio liabilities from Step 2. This will ensure that once we pass on, the portfolio liabilities won't carry over to our future generations.

Instead of being unsure about the insurance coverage, we are very deliberate and specific about utilizing insurance coverage to building generational wealth for generations to come.

STEP 4. TRANSFER OUR WEALTH

Automation and being incontestable is the key to this step. By now we should already know that a Will can be contested and have case studies that display the loopholes and inefficiencies of a Will as much as proponents trying to help write Wills trying to convince us the benefits. Of course, it's better to have a Will rather than not having one at all, but a Will is not as watertight as it seems.

The most efficient solution, in my opinion, is to utilizing Joint investment accounts and automated cash flow distribution methods like e-Giro, Regular Saving Plans (RSPs) and cash transfer or withdrawal instructions, the cash flows from the wealth that we've built from Step 1 to Step 3 can be allocated accurately and undisputably to specific accounts under your control.

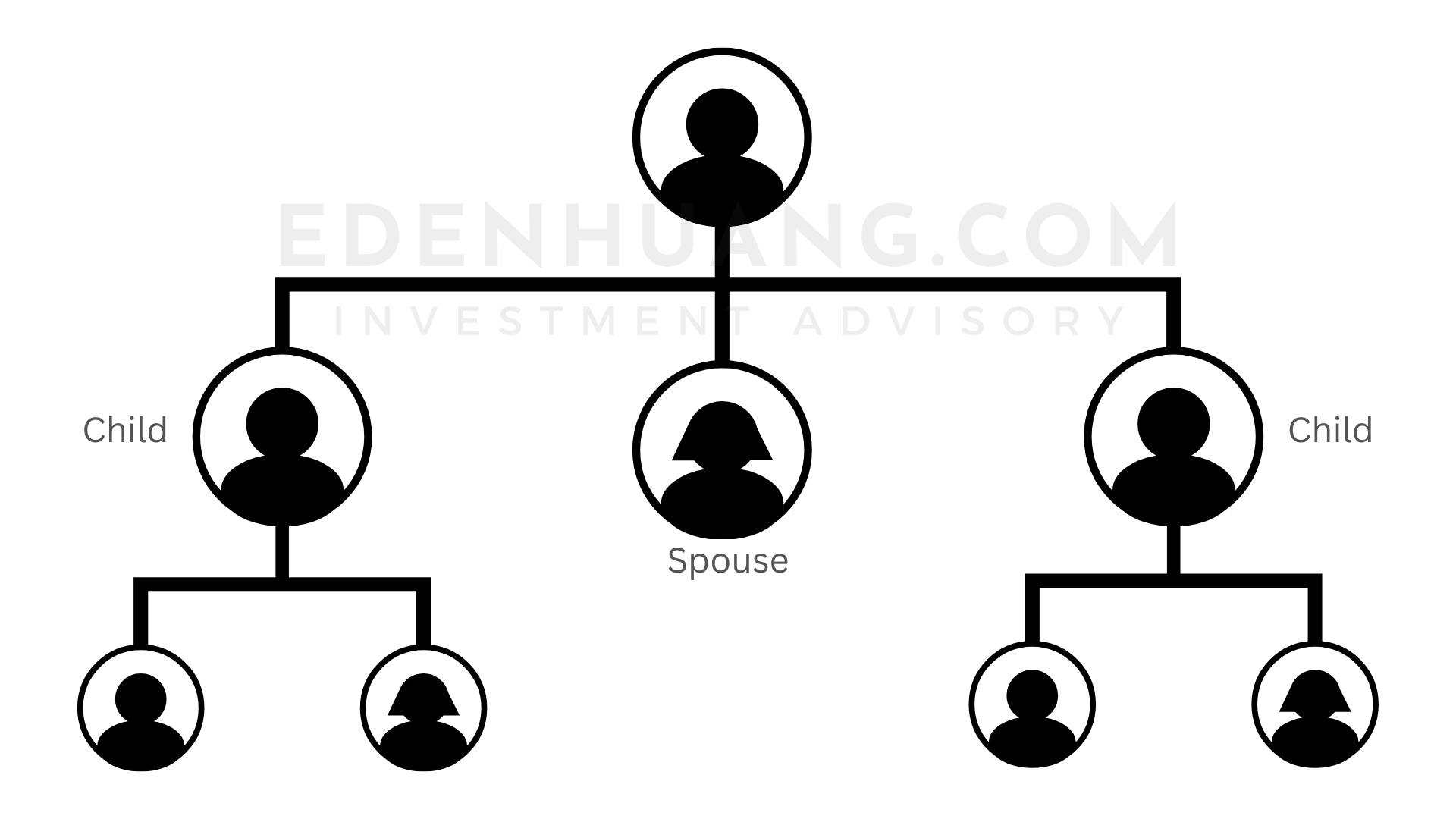

As seen in the diagram, we can have 4 investment accounts under our control:

A Main investment account to replicate Step 1 to Step 3.

A Joint account with our spouse.

Another 2 investment accounts for the kids

Cash flows from the Main investment account can be redirected automatically into the other accounts regularly or manually. Monies can be invested automatically via Regular Saving Plans (RSPs) or manually. When our kids reach 21 years of age, we can convert the investment accounts into joint accounts and impart the investment knowledge to them appropriately. This should set them up for success from the get-go and provide the tools for them to thrive in this inflationary world we live in.

When it's time to pass on, the Cash Flows from Step 1 and Step 2 will fund the insurance premiums in Step 3 to cover the portfolio liabilities and finally in Step 4, joint account holders will automatically become the owners of the investment portfolios.

STEP 5. TAKE ACTION

Implementing the Buy, Borrow, Insure, and Transfer framework is a significant step toward securing your family's financial future, but the true value lies in how these principles are integrated into your unique circumstances. Building a sustainable ecosystem for generational wealth requires a deliberate approach that moves beyond general theory and focuses on the structural resilience of your specific portfolio.

If you are ready to take the next step, I invite you to schedule a professional strategy session. During our time together, we will review your current setup to ensure your assets are positioned effectively against changing global trends. We will work to identify any hidden risks or obstacles that may be slowing your progress and explore a better path that prioritizes long-term stability and growth.

Our goal is to create a clear, actionable solution that gives you the confidence to manage your wealth with precision and clarity. You can select a convenient time for our consultation through the link below to begin refining your strategy for the generations to come.

Terms of Use & Disclaimers:

This blog is managed and written by Eden Huang, a representative of iFAST Global Markets, a division under iFAST Financial Pte Ltd.

Information in this blog is intended for informational purposes only and does not constitute personalized investment advise.

All materials and contents found in this newsletter should not be considered as an offer or solicitation to deal in any capital market products.

Future expectations outlined in this newsletter are based on available data and reasonable assumptions but are not assured. Economic trends and unforeseen events may alter outcomes.

If uncertain about the suitability of the product financing and/or investment product and/or asset allocation strategies, please seek advice from a licensed investment adviser, before making a decision to use the product financing facility and/or purchase the investment products.

Investment products involve risk, including the possible loss of the principal amount invested. Past performance is not indicative of future performance and yields may not be guaranteed.

While we try to provide accurate and timely information, there may be inadvertent omissions, inaccuracies, and typographical errors.

Opinions expressed herein are subjected to change with future economic data.

iFAST Global Markets: Terms and Conditions

This blog has not been reviewed by the Monetary Authority of Singapore.